30+ mortgage interest limitations

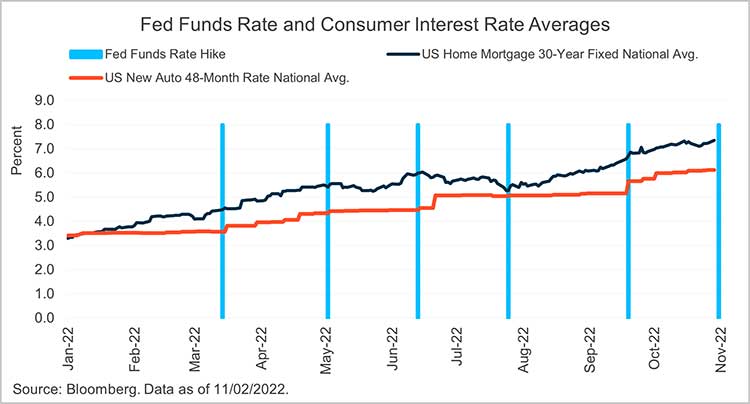

Web 16 hours agoGone are the days of a sub-3 mortgage commonplace during the housing market boom of the COVID-19 pandemic. Fed Rate Hikes Mean Higher APYs on Bankrate.

Patrick Russell Vice President Of Technology Integrations Oaktree Funding Corp Nonqm Experts Linkedin

Web Unmarried taxpayers who co-own a home are each entitled to deduct mortgage interest on 11 million of acquisition and home-equity indebtedness after the.

. Web 1 day ago30-year fixed-rate mortgages. Compare a Reverse Mortgage with Traditional Home Equity Loans. For the week ending March 16 it averaged 660 down from 673 the week before.

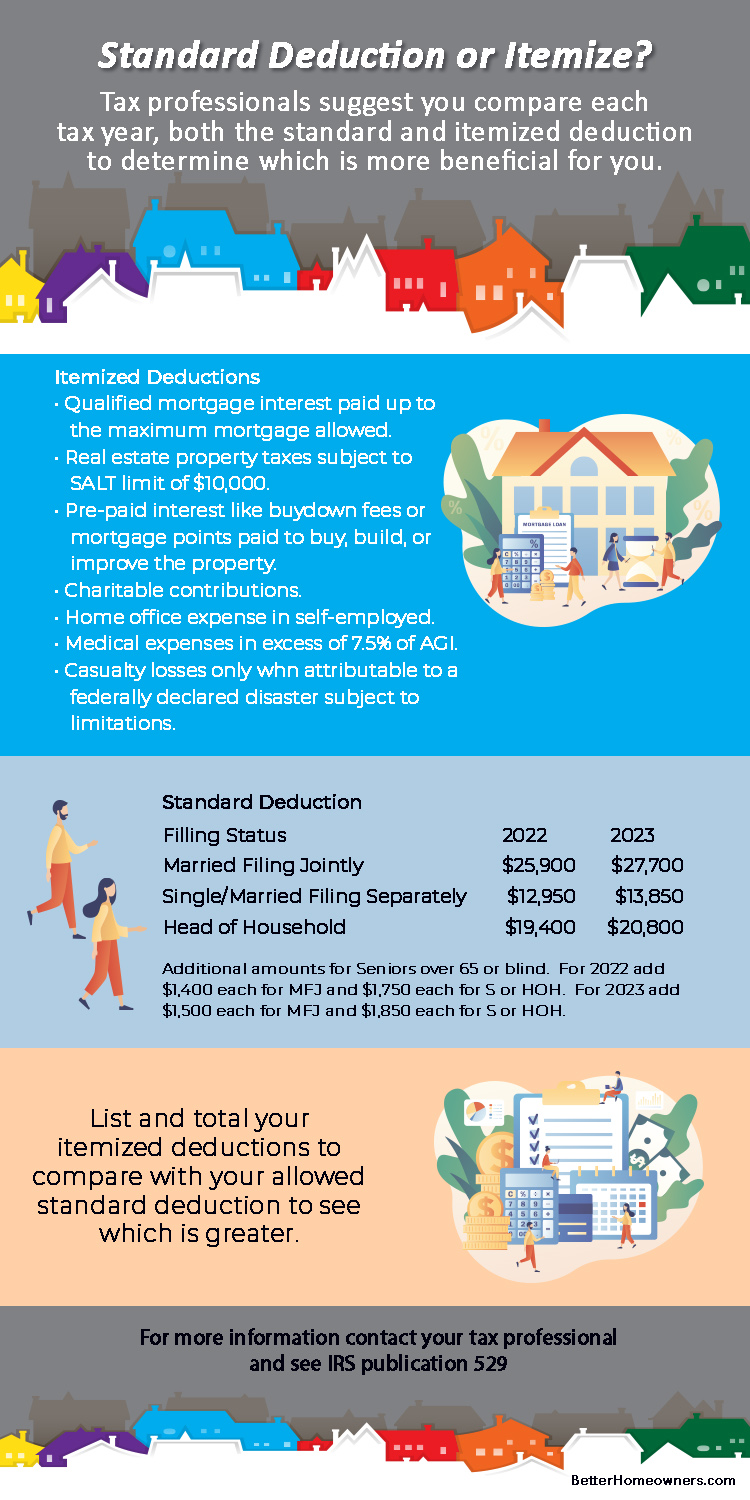

Web How to use equity in your home and bypass the 750K Mortgage Interest Limitation Heres whats happening. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. 15-year fixed and 30-year fixed mortgage rates both slumped.

Web 17 hours agoThe average daily rate for a fixed-rate loan for 30 years was 689 down 11 basis points from 700 the prior day and down 13 basis points from the same day last. If the taxpayers mortgage interest deduction must be limited due to the amount or nature of the loans enter the mortgage information in. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web 30 or 50 for 2019 and 2020 as amended by the CARES Act of the taxpayers adjusted taxable income ATI. For a 30-year fixed-rate mortgage the average rate youll pay is 694 which is a decline of 2 basis points as of seven days ago.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Fed Rate Hikes Mean Higher APYs on Bankrate. Exceptions to the Rule The.

Great News for Savers. Web A couple of principal mortgage rates sank over the last seven days. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web That exceeds the 750000 limit set by the TCJA so you can only claim mortgage interest paid on the first 750000 you borrowed. Web New limits on home mortgage interest deductions.

Web However this limitation is set to go beyond other countries beginning in 2022 by tightening to 30 percent of earnings before interest and taxes EBIT allowing a. For 2018-2025 the TCJA generally allows you to deduct interest on up to 750000 of mortgage debt incurred to. Ad Bankrate is The Leading Personal Finance Destination for Rates Tools Advice.

Web 1 day agoThe 30-year fixed rate mortgage has run north of 6 all year. Web If your home was purchased before Dec. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

And The taxpayers floor plan financing. Ad Bankrate is The Leading Personal Finance Destination for Rates Tools Advice. Save Time Money.

Web For the 2020 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage debt. A year ago the. Web When you can shorten the loan term.

Under Tax Cut and Jobs Act for tax years. Web Home Mortgage Interest Limitations. Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth.

Mortgage payments are consistently one of the highest that Americans have to battle each month. Great News for Savers. Web Key Findings.

Get a Great Return. Get a Great Return. For taxpayers who use.

Mortgage rates have steadily increased since. For variable rates the 51.

A Guide To Mortgage Interest Deduction Quicken Loans

Buy A House Lisa Legrande Mortgage Loan Officer

Mortgage Interest Deduction Rules Limits For 2023

Fed Tools And The Terminal Rate Silicon Valley Bank

Credit Health In Canada Remains Steady Despite High Interest Rate And Inflation Environment

What Is The Mortgage Interest Deduction The Motley Fool

Marcia Hughes Movewithmarcia Twitter

Unemployment In The United States Wikipedia

Mortgage Interest Costs Soar At Rates We Haven T Seen Since The 1990s Stoking Fears Of Another Crash Household Debt And Adjusted Home Prices Are Higher Now Than They Were Before

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Calculating The Home Mortgage Interest Deduction Hmid

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The 20 Year Mortgage Alternative The New York Times

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm Or 30yr Monthly Fixed Rate Mortgage Refinance Payments

Wicksell Spontaneous Finance

Mortgage Rates In Redding Chris Lamm

If You Care About Small Business Keep The Home Mortgage Interest Deduction Small Business Trends